It’s essential to familiarize yourself with an offering plan, especially when purchasing an apartment in NYC. In a real estate transaction, your attorney will review this document during the due diligence process. Offering plans that offer valuable insights, particularly for new developments. However, they are relevant for all apartments, including condos and co-ops. Attorneys have noted that co-op offering plans, which are often decades old, typically only contain pertinent information regarding whether the building is on a land lease.

What is an offering plan in NYC real estate? Where can I find one for my condo or co-op building? Who pays for the offering plan? What information is in a co-op offering plan?

In this article, we’ll explain everything you need to know about offering plans for condos and co-ops in NYC. We will determine how to locate a missing coop offering plan or who typically pays for it.

What Is an Offering Plan?

An offering plan for a condominium or cooperative is similar to a prospectus for an initial public offering of stock or bonds. It is usually several hundred pages long and comprehensively describes every aspect of a property for sale for the first time.

Under the Martin Act, a 1921 law that empowers the New York State Attorney General to combat financial fraud, an offering plan for selling new securities, including interests in cooperatives or condominiums, is required.

No advertising, sales, or promotion of the new property can occur until the Attorney General’s office accepts the offering plan for filing.

Acceptance for filing by the Attorney General does not mean it is a good investment.

This means that the Attorney General’s office believes the offering plan contains the complete disclosures required by the Martin Act. For example, the property could be a wreck, but the Attorney General cannot withhold acceptance until it is repaired. Instead, it can only mandate property disclosures in the offering plan.

Where Can I Find a Building’s Offering Plan in NYC?

Did you know that you can find the offering plans for many buildings currently on sale on the Attorney General’s website? Just click on the link and enter the building’s address. If there is more than one, you need to try multiple entries. If the offering plan is available, you can locate it under the Documents tab.

Avoid asking the managing agent; they usually charge a hefty fee for a physical copy.

Some managing agents may be able to provide a free PDF version, but others may still attempt to charge for it.

The seller is responsible for providing the buyer with a physical copy or a PDF.

They are responsible for obtaining the coop offering plan and other due diligence materials, such as building financials, purchase applications, and house rules. Upon acceptance of the offer, the listing agent should share these documents with the purchaser’s attorney.

When purchasing a condo in NYC, your attorney will likely receive a copy of the offering plan when you accept an offer. Ask the listing agent if your attorney did not receive a copy. If you are the listing agent for a new development condo in NYC, the sponsor, or have recently filed the condominium offering plan.

While most new construction apartments in NYC are condominiums, occasional co-op sponsor sales exist. These co-op sponsor units may be unsold shares previously held back for rent by the sponsor or may be part of a new development.

In the rare case of a coop new development, the sponsor will have just filed an offering plan for acceptance with the New York State Attorney General. Therefore, the listing agent can quickly obtain it from the sponsor. In the case of a sponsor sale for a previously converted co-op, the co-op is almost certainly in possession of a copy of the cooperative offering plan and any amendments.

Finding a Missing Offering Plan for an Old Co-op Building

Suppose the managing agent, your real estate lawyer, neighbors, board members, and various online offering plan databases do not have your building’s offering plan on file. In that case, you can submit a Freedom of Information Law request to the New York State Attorney General’s office.

A response can take 20 business days or more, so you’ll need time and patience if you choose this route.

It’s not necessarily a red flag. Over time, many sections of the original co-op offering plan become irrelevant or outdated. For instance, the original proposed co-op or condo budget from the 1980s, contained in the offering plan, has little to no relevance to a purchaser today.

What Information Is in a Co-op Offering Plan?

Offering plans can be overwhelming. So, which sections are essential for NYC buyers?

Special Risks

You’d expect the Property Description to come first, but it’s the Special Risks section. Right off the bat, the offering plan lists everything buyers should know about this property—and there will be a lot of it. 40-50 risks seemed the norm.

Many of these are boilerplate provisions when the sponsor relinquishes control, including lot line windows and square footage calculation methods. You’ll also find some more unique risks, such as whether there are subway tunnels under the building or the details of any land lease.

Description of Property

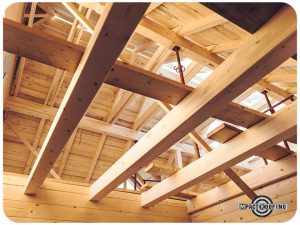

The Description of the Property will provide all the necessary details to ensure there won’t be any surprises. It will include the property’s specific location, the type of property being sold (such as the number of apartments, storage units, or parking spaces), whether there will be any commercial space, the building’s amenities, and much more. The Property Description will provide specific details, including individual appliance models and available internet service providers.

Schedule A

T sponsors lists everything for sale (apartments, storage spaces, parking spots, and bike racks). Of course, the primary focus is usually on the flats. The sponsor must include the price, square footage, number of bedrooms and bathrooms, expected monthly costs, standard charges, and real estate taxes, and the percentage of common elements for each apartment.

- An exciting aspect of offering plans is that sponsors cannot sell a unit for more than the Schedule A price without filing an amendment with the Attorney General’s office.

- However, sponsors can sell at lower prices.

The Notes to Schedule A will also explain square footage methods, typically from outside the walls, which means the actual livable space inside the apartment may be smaller than advertised.

Schedule B

This document contains the sponsor’s condo budget. It includes a detailed list of all the expenses and explains how they were calculated. It also consists of an engineer’s estimate for the common area utility bills and other relevant details.

If the standard charges seem unrealistically low, it is essential to have your attorney examine this section closely. You don’t want to fast-forward a couple of years and realize that the budget was overly optimistic, leaving you with higher-than-expected standard charges.

Property Taxes

There is no specific heading for this, but it is a crucial disclosure. In Schedule A, the property taxes for each unit will be itemized down to the last penny based on a calculated amount for the building’s first fiscal year. However, similar to square footage, it is essential to consider how these taxes are calculated. If the building is under construction for a part of the first fiscal year, the property taxes will be artificially low.

You’ll see lower taxes advertised, but you’ll never actually pay them. In this case, taxes for the second year must also be provided, which will be significantly higher. This situation can be pretty tricky (and, surprisingly, it’s allowed), so it’s crucial to have your attorney investigate this matter.

When is the offering plan deemed effective?

When an offering plan becomes effective, the building will be constructed, and buyers will commit to purchasing apartments. Typically, offering plans can be declared effective once 15% of the units are sold in arms-length transactions, and must be declared effective at 80%.

Before this point, the sponsor can cancel the plan and refund buyers’ deposits. This is rare because the sponsor only makes money by selling the apartments. Additionally, construction usually begins before the offering plan takes effect, so this stage has already invested a significant amount of capital.

Closing costs

The offering plan for a new development property will detail the closing costs buyers must pay. In addition to the standard closing costs for resale buyers, new developments usually require buyers to cover transfer taxes, a sponsor’s attorney, working capital contribution, and, if applicable, a portion of the superintendent’s apartment.

It’s essential to note that these additional fees are included in the purchase price and will be reflected in the recorded price. This could be especially significant if you’re close to any mansion tax thresholds, particularly the $1,000,000 threshold.

Resale Restrictions

Often, sponsors impose restrictions on resale before closeout. The limits can vary. Sometimes, you may not be allowed to resell your unit for a year after closing, and in some cases, a fee may be incurred if you decide to sell.

We saw a 5% “resale fee” if you sell within a year of the building’s initial closing. While most buyers don’t intend to flip the property (and it’s not recommended because you’re likely to lose money), they must be aware of these potential restrictions or costs.

Identity of Parties

Building in NYC can be challenging, so it’s essential to ensure that the sponsor is knowledgeable and experienced. Here, you can find information about the main person behind the sponsor and their involvement in other projects.

Who Pays for the Offering Plan in NYC?

When selling a property, the seller must provide the purchaser’s attorney with a copy of the offering plan. If the seller cannot locate the original copy received at the time of purchase, they are responsible for covering the costs of obtaining a replacement.

If the purchaser decides not to sign the contract, their real estate attorney usually returns the offering plan. In the case of new developments, the developer (also known as the sponsor) may require the buyer to purchase a copy of the offering plan.