Real Estate Commission Rebates in New Jersey – Savings Guide

Go Back To Previous PageOnce you’ve saved for a down payment, checked your credit score, and identified the areas of New Jersey that appeal to you, it’s time to start looking at properties for sale. Given the high home prices and expensive closing costs in the housing market, maximizing your savings when purchasing a home is essential.

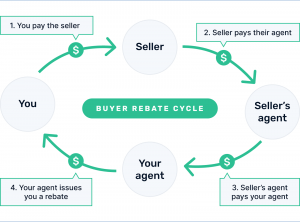

Fortunately, modern real estate brokerages offer commission rebates to help you recover some of your expenses. To inform buyers about these savings opportunities, we have created a concise guide detailing how commissioning rebates can lead to significant savings when purchasing a home or condo in New Jersey.

What is a commission rebate in New Jersey?

If you purchase a home in Fort Lee, NJ, you’ll likely want a real estate agent commission rebate. Also known as a buyer rebate, this option enables buyer brokers to return part of their commission to new homeowners after the sale closes.

homeowners after the sale closes.

However, this option isn’t commonly available. Many traditional brokerages refrain from offering rebates because of outdated practices. For example, sellers typically incorporate broker fees into the home’s pricing to maximize their profits, meaning these fees aren’t explicitly listed on the closing statement for home buyers but are included in the purchase price.

Nevertheless, commission rebates allow you to challenge this conventional approach.

Save money by avoiding the traditional brokerage experience.

When homeowners decide to sell their property, they engage a listing agent to act in their best interests.

While buyers can opt to work independently with the listing agent, we advise having a buyer’s agent. They can assist in formulating offers and advocating for the buyer’s needs.

In conventional real estate transactions, home sellers usually pay the listing broker a 6% commission, which the broker then shares with the buyer’s agent. However, various alternatives exist, so it’s beneficial to consult multiple buyer’s agents and inquire about potential commission rebates.

Recent advancements in real estate technology, partnered with salaried agents, allow innovative brokerages to share a portion of their commissions with the homebuyers they represent.

Secure the most significant commission rebate in New Jersey.

Once aspiring homebuyers are aware that commission rebates exist, the next most common question they ask is, “How much are commission rebates in New Jersey?”

NestApple offers the most significant commission rebate in New Jersey, giving their clients up to 2% of the home’s purchase price back after closing.

For instance, if you bought a condo in Hoboken for $1,500,000, you could receive up to $30000 back after closing.

Commission Rebate in New Jersey – Example

- Purchase Price: $1,500,000.

- Seller’s Agent Commission (3% of the sale price): $45,000.

- Buyer’s Agent Commission (3% of the sale price): $45,000.

- Buyer Commission Rebate (1% of the sale price): $30,000.

Q&A on commission rebates in New Jersey

Are buyer commission rebates legal in New Jersey?

Receiving a buyer rebate in New Jersey is legal when you obtain the keys to your home.

Commission rebates are allowed in 40 states, including New Jersey.

Brokerages can give new homeowners a portion of their real estate commission. An agent might claim they cannot pay an unlicensed buyer. However, this restriction does not apply to buyers involved in a transaction.

Do you pay income tax on a commission rebate?

NesApple can help you secure the home of your dreams. However, as each person’s financial situation may vary, you should consult a tax professional.

The IRS ruled that commission rebates reduce a homebuyer’s cost basis, not income. Brokerages are not required to issue a 1099 related to the rebate.

Aren’t rebates to buyers and sellers prohibited in New Jersey?

Historically, such practices were banned. Section 17(k) of the Licensing Act forbids licensees from providing any rebates, profits, compensation, or commissions to individuals without a real estate license. The only exception to this rule applies to free, discounted, or other services or products permitted under Section 17(i) of the Act.

Has the law changed?

Authorities amended Section 17(k) of the Act to permit real estate brokers to provide rebates to buyers under specific conditions. However, the Act still prohibits rebates for sellers.

Why was this amendment passed?

A broker who operated in several states where buyers’ rebates were permitted introduced a model to represent buyers. This broker offered them a rebate of the commission from the transaction. They argued that buyers should have the same right to negotiate commissions as sellers in listing agreements.

In light of the challenging economic conditions, the Legislature concluded that these rebates benefitted consumers and subsequently passed legislation to allow them, which the Governor signed into law.

So you are saying that only a broker can provide a rebate, and buyers can only receive it?

Only a real estate broker is authorized to provide a rebate; a real estate salesperson or referral agent cannot offer this service. Additionally, the law clearly states that rebates can only be paid to buyers, not sellers.

If I give rebates to buyers, must it be in writing, or can I continue to have a verbal relationship with my buyers?

A broker must establish a written agreement to provide a rebate to buyers at the beginning of the brokerage relationship with them. This documentation can be a written document, an electronic document, or a buyer agency agreement.

Are there any tax implications for the buyers if they receive a rebate?

The broker providing the rebate should recommend that buyers consult a tax professional regarding the tax implications.

Do I have to tell the listing agent I am providing the buyers a rebate?

A broker offering a rebate to buyers must disclose this payment to all parties involved. This includes, but is not limited to, the listing agent, the sellers, and the mortgage lender. Furthermore, the broker must adhere to all state and federal regulations regarding disclosing the rebate payment.

Can I condition the payment of a rebate to buyers on the buyers using some other service or product that I offer?

The rebate cannot depend on using any other services or products the broker or its affiliates provide. Furthermore, the rebate must not be tied to participation in any lottery, contest, or game.

Are there any advertising issues I should be aware of if I offer rebates to buyers?

Advertisements related to rebates must meet several essential requirements. First, the ad must include a disclosure stating that buyers are responsible for paying any applicable taxes on the rebate they receive. Next, it must include a notice advising purchasers to consult a tax professional regarding the tax implications of the rebate.

Finally, the disclosure and notice should be prominently displayed in the advertisement, with the text size equal to or larger than that used for the main content.

Can I give the buyer a rebate for undertaking activities that real estate licensees might otherwise do?

You are not allowed to pay any unlicensed individuals, including buyers, for any services that require a license.

Therefore, you cannot give them a credit or a check at the closing for providing licensed services.