NYC security deposit law in 2025

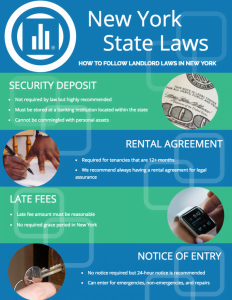

Go Back To Previous PageNYC security deposit law remains part of renting an apartment in NYC. Luckily for tenants, New York State laws have changed recently, offering them more rights and protections. Let’s discuss the NYC security deposit return law.

What is a security deposit?

A security deposit is a sum a tenant deposits with the apartment’s landlord when the tenant initially signs a lease. Tenants use the security deposit money to protect the landlord from any financial damages to the property. It may also pay for other fees for which the tenant is responsible when they vacate the apartment. Let’s analyze some NYC security deposit laws governing how landlords deal with them.

Under New York State law, a landlord cannot force a tenant to deposit more than one month’s rent security.

Under the revised New York State Law, it is illegal for a landlord to collect more than one month’s rent from a tenant. The prior law only applied to rent-stabilized tenants, but now it applies to all tenants. This has been great news for tenants. Still, it does present some problems for international residents and students.

applied to rent-stabilized tenants, but now it applies to all tenants. This has been great news for tenants. Still, it does present some problems for international residents and students.

Indeed, they previously relied on putting down more extensive security deposits to qualify for a rental agreement. They couldn’t meet the income requirements.

For example, a rent-stabilized tenant deposits two months’ security deposit when the apartment first came under rent stabilization. Then, the landlord must refund the tenant any additional security deposit. This amount is more than one month’s rent when the tenant reaches the age of 65 or receives SS disability retirement benefits.

Security Deposit Alternatives

In recent years, numerous enterprising startups have offered alternative solutions to traditional security deposits. One example is Rhino,  which lets you pay a small monthly insurance premium instead of a security deposit. You won’t have to put down a significant security deposit using this service.

which lets you pay a small monthly insurance premium instead of a security deposit. You won’t have to put down a significant security deposit using this service.

This is happening in the UK, too, with sites like Portico Direct offering private landlords online, low-cost options for registering a tenant deposit, ensuring tenants can get into the property more quickly. However, you may be responsible for certain excessive damages you may cause to the property.

Consequently, read the fine terms regarding the specific insurance coverage provided. It’s also important to note that while these services are becoming more widespread, not all landlords will accept them.

Landlords must hold the Deposit in an interest-bearing account under the current NYC security deposit law.

If a landlord owns a building with more than six units, this landlord must deposit the Deposit into an interest-bearing account with a New York State bank. Upon Deposit, the landlord must notify the tenant in writing with the name and address of the bank.

The tenant is entitled to collect less than 1% annual interest for the landlord’s administrative costs. With interest rates at 0%, this is not a priority.

What Happens If the Tenant and Landlord Renew the Lease under NYC security deposit law?

Consider when a tenant signs a lease renewal at a higher monthly rent. Then, the landlord can collect the difference between the old and new monthly rent. Therefore, the security deposit held matches the new lease. This is true even if a tenant is exempt from paying the increase due to receiving a “Senior Citizen Rent Increase Exemption” (SCRIE) or Disability Rent Increase Exemption (DRIE).

Your landlord will notify you if they need you to pay the difference in the security deposit.

Security Deposit Rules When Selling a Property

If a property changes ownership, the landlord must transfer all security deposits to the new landlord and notify all tenants, in writing, by certified or registered mail, within five days of the change in ownership. In that written notice, the old landlord must provide the tenant with the new landlord’s name and address.

registered mail, within five days of the change in ownership. In that written notice, the old landlord must provide the tenant with the new landlord’s name and address.

Return of Security Deposit when Tenants Vacate

Many tenants mistakenly believe they can use their security deposit as the final month’s rent. This is incorrect. When a tenant vacates an apartment and leaves the property in the same condition as when rented, subject to normal wear and tear, the landlord must return the entire security deposit.

However, if a tenant damages the apartment, the landlord may apply part or all of the Deposit to cover the cost of repairs. To protect themselves, tenants should take pictures of the apartment when they move in and when they vacate, in case there is a dispute after the tenant vacates.

New York State law requires that landlords return the security deposit to tenants within a reasonable time frame after the tenants have vacated the property and provide tenants with an itemized receipt.

Normal wear and tear vs. damage

While wear and tear are subject to interpretation, it typically includes the following:

- Painting walls

- Chipped paint or scratched walls

- Worn carpets or lightly scratched floors

- Slightly worn or scratched countertops

- Holes in walls from paintings or other wall hangings

- Dust and dirt, including dirty windows

Most minor damage occurring during a lease will fall under normal wear and tear. Those cannot result in your landlord keeping part of your security deposit. More severe damage, such as holes in the walls, significantly damaged floors or tiles, broken or burnt countertops, or stained carpets or floors, can result in a penalty.

Should the landlord find damage to the apartment, they are not required to give you a chance to repair it, meaning that they can immediately deduct the cost of repairs from your security deposit.

What if your landlord wrongfully deducts or doesn’t return your security deposit

If the tenant disagrees with the landlord over the return of the security deposit or payment of interest, or if the landlord does not return the security deposit, the tenant may begin a case in small claims court. Tenants may also contact the Consumer Frauds and Protection Bureau of the New York State Attorney General’s Office to get the proper security deposit returned.

The Takeaway

It may be inconvenient to deposit an entire month’s rent as a security deposit. However, the trend of locking up so much cash is slowly changing for the better. NYC security deposit laws have changed recently, and more has been done to protect tenants’ rights.