New York Mansion Tax Guide

Go Back To Previous PageIf you plan on buying a home in New York, there’s a good chance you’ll be paying a mansion tax, as this tax applies to all homes selling for over $1  million in the state. In 2019, authorities introduced a new progressive mansion tax in NYC. For these reasons, we wrote the ultimate 2022 guide to the NYC Mansion Tax. How can you avoid paying the mansion tax in NYC? That means if you purchase a property for $1 million, you’ll be paying a $10,000 mansion tax, and no tax will be due if you buy the property for $999,000. For this reason, you’ll find that many NYC properties are priced just below $1 million, while the few properties priced at exactly $1,000,000 will generally sell for a few bucks below that.

million in the state. In 2019, authorities introduced a new progressive mansion tax in NYC. For these reasons, we wrote the ultimate 2022 guide to the NYC Mansion Tax. How can you avoid paying the mansion tax in NYC? That means if you purchase a property for $1 million, you’ll be paying a $10,000 mansion tax, and no tax will be due if you buy the property for $999,000. For this reason, you’ll find that many NYC properties are priced just below $1 million, while the few properties priced at exactly $1,000,000 will generally sell for a few bucks below that.

There are new mansion taxes in place in NYC.

It all started a couple of months ago with the record sale of the penthouse at 220 Central Park South. While costly real estate deals are nothing new in NYC, this one woke up a behind-the-scenes discussion that had been happening for a while.

To give you an idea, this purchase broke the city’s record for the most expensive condo sale, with an astounding difference of $138,000,000 from its runner-up.

What came after was a debate about how the city had become a playground for the rich. The subway desperately needs repair, and a pied-à-Terre tax seemed easy. “When over six million New Yorkers are dealing with a crumbling and dysfunctional subway and the crisis in public housing, to see this opulence in the sky by someone who doesn’t even live here struck a chord,” the City Council speaker, Corey Johnson, said.

Therefore, a good headline combined with a political movement! The anti-Amazon/anti-corporate feelings in Queens resulted in talks to find ways to collect more taxes.

How Much is the NYC Mansion Tax?

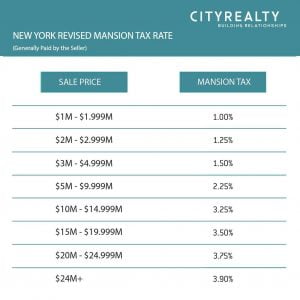

Initially, the mansion tax was a statewide 1% tax on all properties sold for $1 million or more. However, in 2019, legislators passed a bill introducing a new,  progressive mansion tax in New York City.

progressive mansion tax in New York City.

The NYC rates increased to 3.9% on properties that sell for $25 million or more. You can view the rates below.

Our NYC buyer closing cost calculator calculates your potential mansion tax bill.

| Home Price | NYC Mansion Tax Rate for Fiscal Year 2020 |

| $0 – $999,999 | No Tax |

| $1,000,000 – $1,999,999 | 1.00% |

| $2,000,000 – $2,999,999 | 1.25% |

| $3,000,000 – $4,999,999 | 1.50% |

| $5,000,000 – $9,999,999 | 2.25% |

| $10,000,000 – $14,999,999 | 3.25% |

| $15,000,000 – $19,999,999 | 3.50% |

| $20,000,000 – $24,999,999 | 3.75% |

| $25,000,000+ | 3.90% |

Who Pays the Mansion Tax in NYC?

The mansion tax is the buyer’s responsibility and is due within 15 days of closing.

Guide to the NYC Mansion Tax: Can You Avoid Paying the New York City Mansion Tax?

While this tax applies to all properties, whether condos, co-ops, or townhouses, some strategies exist to avoid the mansion tax and other buyer closing costs.

buyer closing costs.

Get a buyer’s real estate agent commission rebate.

- The best way to reduce your closing costs when you purchase a home in NYC is with a commission rebate. You’ll be getting a 2% rebate, which will more than cover the mansion tax costs on a $1-2 million home. Even if you found the house, bringing in a buyer’s broker to represent you is likely in your best interest.

- However, it’s a common misconception that buyers think they’ll get a better deal if they’re unrepresented, but the seller’s broker will usually collect a more significant fee.

-

Use a rider-

How can the mansion tax in NYC be avoided? Another way to mitigate the mansion tax is to use a rider to purchase some of the apartment furniture. This shouldn’t be abused (for example, you might be able to buy $10,000 of furniture to bring a home down to $999,000 instead of $1,009,000, but trying to purchase $100,000 of furniture will likely set off red flags. Regardless, you should consult your real estate attorney.

-

Ask the seller to pick up the tab.

– Everything’s negotiable in NYC, and if you’re purchasing when the market is soft, you can certainly ask the seller to cover the NYC mansion tax. Your broker can advise if it makes sense to ask for this or if offering a lower sale price would be better.

You might also ask yourself if you can pay some of the seller’s closing costs to avoid the mansion tax, but this won’t work. For example, purchasing a sponsor unit and picking up the transfer taxes will be tacked to the purchase price when calculating any potential mansion tax. If you have any questions, please get in touch with us after reading this NYC Mansion Tax guide!

This, coupled with a one-time transfer tax, is expected to generate $365 million annually, which will be invested in funding the MTA.

To Pamela Liebman, president of brokerage Corcoran Group, the new mansion taxes damage the whole market. She claims officials are also sending a loud-and-clear message that it doesn’t matter if the barrier to entry becomes unreasonable for large spenders. In the past weeks, the brokerage has lost deals in the $25 million range over concerns about taxation.

How and When Do You Pay The Mansion Tax?

While the New York City mansion tax is technically due within 15 days of closing, you should expect to pay it on your closing date. If you’re closing on a co-op property, the seller’s real estate attorney will collect the tax and send it to the county clerk.

If you’re purchasing real property (a condo or a house), the tax gets collected by your title company, which will then send it to the county clerk.

What is the Future of the NYC Mansion Tax?

The mansion tax was introduced in 1989 by Governor Cuomo’s father and applied to “mansions.” However, authorities never adjusted the tax for inflation, and it became a tax on virtually any condo in Manhattan. Adjusting for inflation, $1 million in 1989 is over $2 million today. And let’s be honest, who would call a $1 million studio a mansion?

Yet, even with this in mind, it’s unlikely that the tax will change soon as authorities recently expanded it.

Pied-à-Terre taxes are ordinary in cities like Paris, Vancouver, and Singapore. Locally, both houses of the state legislature and Governor Cuomo supported the legislation; their argument was:

The financial impact could be significant. New York City has about 75,000 pieds-à-terre, according to a city estimate from 2017. Of those, about 5,400 residences did sell for $5 million or more, the threshold where the proposed pied-à-Terre tax would begin to kick in.

The new budget had to be approved by April 1st. A few days before the deadline, during a press conference, Governor Cuomo said the pied-à-Terre was off the table (for the moment). He promised they were coming up with an alternative: the new mansion tax.

Mayor De Blasio Has Tried to Change the Laws

During his tenure as mayor, Bill De Blasio proposed reforms to the NYC mansion tax. For example, in 2015, he suggested changing the tax law to only apply to properties that sell for more than $1.7 million. State lawmakers rejected the proposal, and in 2017, he tried again, proposing to raise the tax to 2.5%, but only to have it applied to properties that sell for $2 million or more.

The proposal was also rejected, and considering the recent expansion of the tax last year, it’s doubtful that we’ll see any adjustment to account for inflation.

Our prediction

At Nestapple, we predict the opposite: there will be almost no impact on the city’s luxury market. There was already a barrier to entry, making it a bit harder. If you can afford six-figure properties, the increment will not be significant, and we don’t think it will derail buyers from investing or staying in the city. A pied-à-Terre tax would have been significantly more damaging.

Overall, if this means the subways will run on time and be more efficient, we think it’s a good solution.