Deadlines in real estate transaction in New York

Go Back To Previous PageA buyer (let’s call her Sally Streetwise) works with her broker to find a property she loves in a beautiful coop and begin her real estate transaction. The brokers work with the buyer and the seller to reach an agreement on the purchase price, review the board package, and agree on the timing and other relevant matters. The brokers can then turn the deal over to the lawyers to conduct due diligence.

Attorneys negotiate the contract. After much back-and-forth between lawyers and clients, the contract is finalized. The buyer signs the contract and submits her deposit check. The seller’s attorney deposits the check into an escrow account.

Then, it becomes fully executed, meaning the contract is legally binding. From that moment, it’s essential to remember all the deadlines, including the commitment letter and Board Package, in this real estate transaction management in NYC.

You might think this would be an excellent point for the brokers, lawyers, buyers, and sellers to take a collective sigh of relief. Can they pat themselves on the backs and look forward to a smooth closing? Alas, there is no rest for the weary in Manhattan real estate.

You might think this would be an excellent point for the brokers, lawyers, buyers, and sellers to take a collective sigh of relief. Can they pat themselves on the backs and look forward to a smooth closing? Alas, there is no rest for the weary in Manhattan real estate.

The New York residential real estate contract will not satisfy itself with only one deadline.

The New York residential real estate contract will not satisfy itself with only one deadline.

There are multiple deadlines:

- to apply for mortgages

- and to obtain Commitment Letters

- to submit board packages

- for providing notices

- to schedule closings

- to adjourn closings

- and deadlines that increase stress and confuse everyone throughout the process.

Some lawyers, bankers, and brokers push forward quickly, hoping to avoid deadline landmines. However, experienced practitioners will help buyers navigate deadlines to lessen stress and protect their best interests.

The board package submission deadline and the Loan Commitment Letter deadline

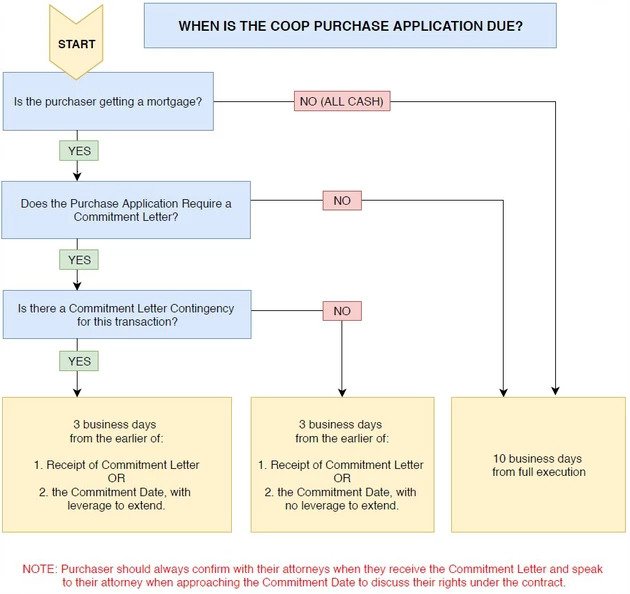

Let’s get acquainted with two of the most critical deadlines our buyer will encounter once she gets into contract: the board package submission deadline and the Loan Commitment Letter deadline (“Commitment Date“).

One commonly used contract contains multiple deadlines for submitting the board package. They depend on various circumstances that might exist:

-

If Sally Streetwise is not seeking financing

If buying “all cash,” she must submit her board package within ten business days of her attorney’s receipt of a fully executed contract.

-

But if Sally is seeking financing (regardless of loan amount) for her real estate transaction

The board package deadline will determine whether a commitment letter is required to get submitted with her board package.

-

- Suppose the board does not require a commitment letter as part of the board package. Then, the original ten-business-day deadline is still in effect. However, most boards do require a commitment letter. Most boards believe the deal will not go forward if a buyer cannot obtain a commitment letter.

- Suppose the board requires a commitment letter as part of the board package. Then, the contract will include the Commitment Date, usually thirty or forty-five days from when Sally’s attorney receives a fully executed contract.

-

-

- If Sally’s contract has a Commitment Letter contingency, her deadline is three business days from receiving the Commitment Letter.

- If, on the other hand, Sally is seeking financing, but her real estate transaction does not include a Commitment Letter contingency. Then Sally’s deadline is three business days from the earlier:

- When she receives the Commitment Letter.

- The Commitment Date.

- There is one crucial caveat. Even if Sally has not obtained a Commitment Letter by the Commitment Date, she must still submit her board package within three business days from the Commitment Date.

-

Your brokers help you navigate through deadlines in real estate transactions in NYC.

We always recommend that a buyer obtain a copy of the board application before entering the written contract with her broker’s assistance.

real estate transaction management

For bankers working on the commitment letter

For bankers working on the commitment letter

There are dozens of types of mortgages. Regardless of the one chosen, several open conditions may initially exist in the commitment letter. The banker should work with the client to eliminate as many available conditions as possible before the Commitment Date.

For example, a banker states that Sally Streetwise’s parents must provide a “gift letter” to improve her financial situation.

It would be best to obtain the gift letter and have that condition cleared from the commitment letter rather than having the commitment letter issued with the open condition. What if Sally’s parents refuse to sign a “gift letter” for the funds they provided her? We need to discover these potential issues in the contingency period rather than after the contingency has lapsed.

It is also critical to have an experienced banker.

It would help if you had a banker familiar with the interplay of the Commitment Date and the board package timeframes. The institution providing your home loan should be experienced and efficient. However, inadvertently, they trigger the 3-day deadline described above when the borrower is not yet ready to submit the board package. Sally Streetwise wants to have an open dialogue with her banker and real estate agent.

This way, they take the time to prepare a board package that shows Sally in the best light. Sometimes, this means waiting until the most recent bank statements are available from the buyer’s bank or waiting until the perfect source of a professional reference returns from vacation.

There is one notable exception to the above.

What should Sally do when obtaining a commitment letter, which is still subject to a satisfactory appraisal? However, the bank has not yet conducted or approved the appraisal. In such a case, the typical real estate contract states that a commitment letter subject to an assessment is not a “Commitment Letter” as defined in the contract.

Unless and until the appraisal condition is satisfied. The first goal would be to satisfy the appraisal before sending the Commitment Letter as part of the board package.

However, sometimes the broker wants to submit the board package quickly, for example, to meet the next board meeting deadline. They would prefer to submit the commitment letter with the appraisal condition in such cases.

In such a case, the buyer may provide the commitment letter even though it is still subject to an appraisal. However, the buyer should state that it is a preliminary commitment letter. The buyer keeps the right to cancel under the standard commitment letter contingency clause.

One final note on deadline extensions in real estate transactions

Buyers should take note that in the world of contract law for a real estate transaction, there is a difference between:

- a deadline where a buyer receives a right of action

- a deadline where a buyer has no such right.

For example, take the case where a buyer with a finance contingency has done her best to cooperate with the bank to obtain a commitment letter. Still, through no fault of her own, the bank cannot issue the commitment letter before the typical thirty-day deadline. In such a case, the buyer would potentially have the right to cancel the contract.

A buyer could request an extension of that deadline from the seller instead of exercising the right of cancellation—this wielding of the implied power to cancel often results in the seller granting an extension.

Contrast this situation with the deadline to submit a board package. In normal circumstances, the buyer does not have a right to cancel if the board package is not submitted on time. Therefore, the buyer may not successfully seek an extension for such a time.

Contrast this situation with the deadline to submit a board package. In normal circumstances, the buyer does not have a right to cancel if the board package is not submitted on time. Therefore, the buyer may not successfully seek an extension for such a time.

Requesting an extension in such a circumstance comes with risk. Suppose the seller disagrees (and they are not required to do so). In that case, the buyer must rush to submit the board package or risk becoming in material breach of the contract, potentially subjecting the buyer to the deposit’s loss.

If a broker or client is concerned with the board package submission deadline, the most effective time to address this is during the contract negotiation stage. Attorneys can add additional time to the contract.