Condo Vs Coop in NYC: What to buy?

Go Back To Previous PageReal Estate 101: Before buying a home or renting one in New York, you must master these concepts. Condo vs. Co-op in NYC: What to Buy? If you’re purchasing a home in NYC, it’s essential to understand the pros and cons of buying a “Condo” versus owning a “Co-op.” Condo vs. Co-op ownership in NYC remains an important topic. Our guide will explain the differences between them. We will then go over the following questions. Also, pay attention to air rights.

1. What is a co-op?

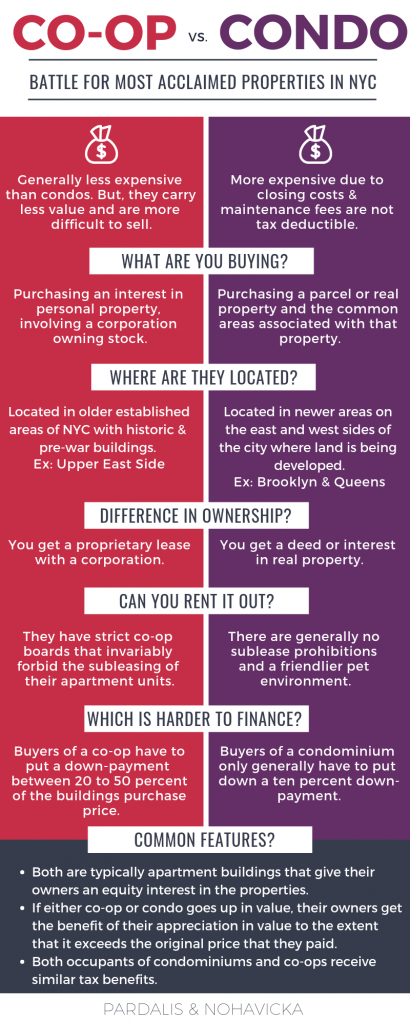

If you buy an apartment in a cooperative building, you won’t own your specific unit. Instead, you’ll own shares of a co-op corporation that owns the building.

These shares come with what’s called a proprietary lease. This lease gives you the right to live in the unit. The larger your home, the more shares you own within the corporation.

Monthly coop maintenance fees cover building expenses, including utilities, insurance, and staff. Another difference is that the entire cooperative building receives one instead of individual tax bills for each unit.

To account for this part of the monthly maintenance charges, pay the building’s property taxes. As monthly maintenance includes taxes, you’ll typically see higher maintenance charges in coops vs. condos in NYC.

This is a wash when you combine condo maintenance fees and property taxes.

-

Pros of Co-ops:

The most significant benefit of purchasing in a co-op building is that it is less expensive than a condo. There are several reasons for this: co-ops comprise about 75 percent of New York’s housing inventory.

They also require an additional layer of approval. Coops are more restrictive with who they let in, and co-ops have higher owner-occupancy rates than condos since most co-op boards typically disallow investors.

Due to this, conventional wisdom says a co-op offers more stability. Co-op boards rigorously vet potential buyers and have the right to approve or deny each purchase.

-

Cons of Co-ops:

Co-op buyers will endure a more rigid approval process, including an in-person interview with the co-op board. After searching for an apartment for months and going through the grueling approval process, a buyer can get rejected for any reason.

Foreign buyers typically cannot purchase co-ops, don’t have the necessary history with U.S. banks, and generally lack sufficient U.S. credit history.

Co-op boards also require higher down payments, and most coops require a minimum of 20% of the purchase price. Some more selective co-ops require even more (up to 50%), while others don’t allow purchasers to get loans.

Each cooperative property has its own rules. Most tend to be restrictive regarding how to use your unit. You will often be limited or forbidden from subletting your apartment. Some co-ops also disallow use as a pied-à-terre.

When you sell your co-op apartment, the extra approval can make it more difficult. You could lose a great buyer due to a board rejection and have to return to the market.

Additionally, most co-ops have a flip tax due at closing, ranging from 1% to 3% of the sale price. This tax beefs up the building’s financials. Remember that even with a high flip tax, co-op closing costs are significantly lower than condo closing costs.

2. What is a condominium?

Condos are “real” property; each unit has a deed and an individual tax bill.

The main difference between coop and condo ownership is that you own a condo free and clear. However, like with a condo anywhere, you are subject to the rules and regulations the condo board sets.

Monthly common charges cover the condo building’s operating costs, while property taxes get billed separately.

-

Pros of Condos:

If you purchase a condo, you own the property as opposed to owning “shares” in a cooperative corporation. This means that you will not be subject to approval by the board or the many highly restrictive rules standard in co-ops.

As you own your condo, the board cannot dictate things like the minimum down payment amount, subletting policies, or investor rules instead of being a corporate member. Owning a condo is like owning real estate anywhere else in the U.S. You own it, and you can typically do whatever you want with your property. Companies like Precondo can provide valuable resources and assistance to individuals looking to purchase a condo.

However, we recommend reviewing the condo declarations and house rules for any condominium building since the fine print can reveal some interesting information. Condos can be purchased as investment properties, and unit owners can freely sublet or lease out their units.

With fewer to no-use restrictions, condos are much easier to sell. They also appeal to foreign buyers.

One thing to note is that most condo boards will disallow rentals of less than 30 days, and some will even frown upon shorter-term rentals of less than one year. In some instances, when a condo has too many investors compared to owner-occupants, getting a loan may become more complex.

If this happens, the condo boards may try to disallow non-owner occupant buyers.

-

Cons of Condos:

While condos’ incredible flexibility makes them much more desirable, they are also more expensive. Another factor that makes them even more costly is the limited supply and insatiable demand, particularly from foreign buyers who are unable to purchase co-ops and who all want to own a piece of highly-coveted NYC real estate. Buying a condominium also means higher closing costs.

For example, a mortgage recording tax will not be required when buying a co-op if you get a loan. However, as fewer condos and coops are available in the NYC real estate market, your options may also be limited.

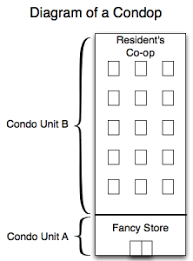

3. Condo Vs. Coop in NYC: and what are condops?

Most of New York City’s residential real estate market is condos and co-ops. However, it’s also possible that you’ll encounter something a bit different during your home search: a condop. A condop is a co-op that was formed inside a condo building.

Generally speaking, the bottom of the property is typically a single condo unit that houses a mix of commercial and retail space. However, condops operate under condo rules. Above all, the residential areas are part of a single, giant condo unit in which a co-op is formed.

As a result, individual apartments can be divided via several shares among the owners.

The condop residents will operate under co-op rules, but the co-op has to abide by the condominium’s rules. That means that both sets of regulations are in effect for condop owners. In general, it’s fair to say that condops function more like co-ops regarding the application and approval process.

Like co-op owners, condop owners will own several shares in the building while paying HOAs, including taxes.

4. Condo Vs. Coop in NYC: what is the difference between their condo and co-op boards

“Condo Vs. Coop in NYC”: that is the question. Owning a condo is like owning a house. When buying a condo, you receive a deed and specified pieces of real estate. Conversely, when buying into a co-op, you maintain shares of corporations that own the buildings where their units are.

Condos are typically more expensive by at least 25%.

Both condo and co-op boards require buyers to complete and submit a complex financial application after signing a contract, frequently using a REBNY Financial Statement. While both condos and coops will need a board review and approval of any potential purchaser, there are some crucial differences:

- Co-op boards can deny a prospective purchaser without disclosing their reasons. If they reject an applicant, the seller must return the property to the market and search for a new buyer.

- Condo boards have a “right of first refusal.” While condo boards take advantage of this right and use it to review each prospective buyer’s application, they can only exercise their right of first refusal if they have a problem with the sale or the buyer. Even though they can delay the process, they can’t reject a purchaser for no good reason.

If you’d like more information on this or want to discuss whether a condo or a coop in NYC is suitable, don’t hesitate to contact us at nicole@nestapple.com.