Can a Co-Signer or Guarantor Help You Get a Mortgage

Go Back To Previous PageMany people dream of buying a co-op or condo in New York City. However, it’s a pipe dream because they know they can’t qualify for a mortgage. They may have a low income, bad credit, or no savings, to name a few. But did you know that a person who faces financial difficulties can qualify for a mortgage? They can reach out to a Co-Signer or Guarantor in New York. A Co-Signer or Guarantor in New York can help you secure a mortgage. Then, your dream of owning a condo or a co-op may come true.

qualify for a mortgage. They may have a low income, bad credit, or no savings, to name a few. But did you know that a person who faces financial difficulties can qualify for a mortgage? They can reach out to a Co-Signer or Guarantor in New York. A Co-Signer or Guarantor in New York can help you secure a mortgage. Then, your dream of owning a condo or a co-op may come true.

If you have no credit history in favorable terms or no credit profile, seeking financial help will boost your chances of acquiring a loan. That’s why people combine forces with a Co-Signer or a Guarantor in New York. So what is a Co-Signer or Guarantor in New York?

And can they help you get a mortgage in New York? We’ve got you covered. If you want to buy a condo or co-op, read about borrowing a loan with someone else.

What is a Mortgage Co-Signer in New York real estate?

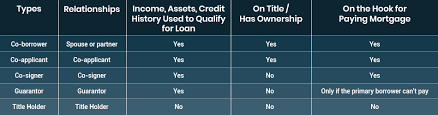

A co-signer can help you qualify for a home mortgage or seller financing when you have a low or bad credit score, limited finances, or a high debt-to-income ratio. A co-signer is a “co-borrower” or “co-applicant.”

limited finances, or a high debt-to-income ratio. A co-signer is a “co-borrower” or “co-applicant.”

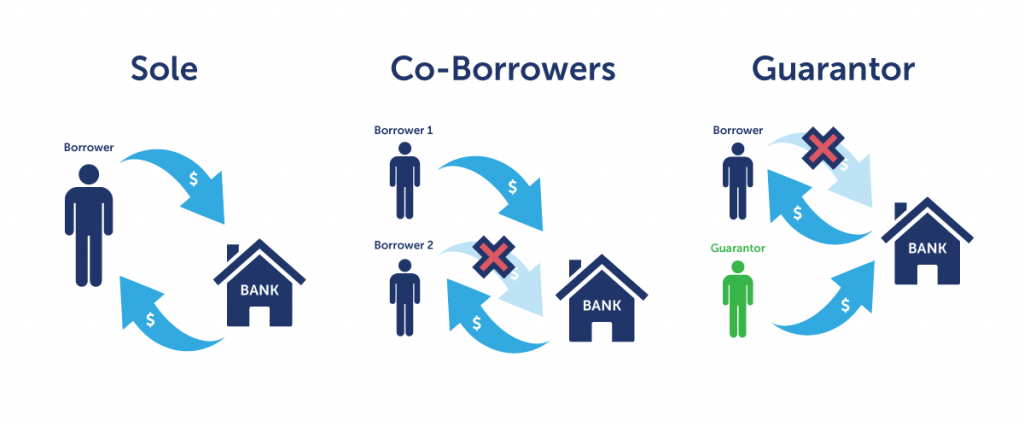

The co-signer will take out a mortgage with the borrower and get listed on the mortgage as an additional borrower. Therefore, the co-signer’s income, assets, and credit history enter into play to secure the loan. The co-signer must have an excellent credit score, a high income, and few or no financial blemishes throughout the years. In short, the co-signer lends their good name and credit history to help the buyer secure a loan.

The borrower and the co-signer will eventually own the co-op or condo jointly. Their names will both appear on the property’s title. The borrower is responsible for paying the mortgage. However, since their name is on the title, the co-signer is equally liable for making the loan’s monthly payments.

But there is a distinction.

The mortgage lender typically receives payments from the borrower, and the co-signer only comes in when the borrower fails to make a payment. This distinction is essential because the co-signer is responsible and obligated to pay if the borrower somehow defaults.

make a payment. This distinction is essential because the co-signer is responsible and obligated to pay if the borrower somehow defaults.

A co-signer, then, is a backup for the lender and a security measure. It lets the lender know that the loan gets paid without resorting to extraordinary measures.

For example, suppose the borrower has stopped making payments for any reason. In that case, the co-signer may have to cover the missed costs and penalties, such as late fees, additional interest, and more. As a result, becoming a co-signer is always a risk.

Who is the Co-Signer of a loan in New York?

The co-signer is sometimes a family member, relative, or friend unrelated to the borrower. However, the co-signer is usually the spouse or is romantically involved with the primary borrower. The lender refers to the co-signer who is not married to the borrower as the “co-applicant.” The lender issues individual loan applications for the same mortgage.

Therefore, the lender considers both the borrower and co-signer as independent entities with separate finances. However, if the co-signer is the borrower’s spouse, the two will only fill out one mortgage application form together.

The co-signer does not have to live with the borrower in the apartment they jointly own. They can live elsewhere even if their name is on the mortgage or deed. Also, co-signers don’t need to be on the deed, but both names remain permanently on the borrower’s mortgage.

Co-signers are not needed to qualify for mortgages if borrowers have enough funds to take them on themselves. However, the co-signer and borrower can still work together to afford a larger mortgage with lower interest rates.

What is a mortgage Guarantor in New York real estate?

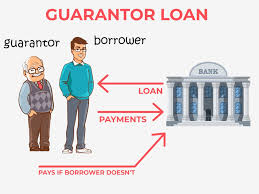

A guarantor is similar to a co-signer, as they help out the borrower. In a nutshell, a guarantor guarantees mortgage payments to facilitate mortgage approval. Unlike borrowers who need co-signers’ assistance, guarantors may have the finances to carry a mortgage independently but have difficulties securing a loan.

payments to facilitate mortgage approval. Unlike borrowers who need co-signers’ assistance, guarantors may have the finances to carry a mortgage independently but have difficulties securing a loan.

Maybe they have a low credit score or have significant credit issues.

Difference Between mortgage Co-Signer and mortgage Guarantor in New York

There’s a difference between a Co-Signer and a Guarantor in New York. Guarantors don’t have the same property rights as co- signers since their name is only on the mortgage and not the property title. The guarantor helps get mortgage approval and guarantees mortgage payments.

signers since their name is only on the mortgage and not the property title. The guarantor helps get mortgage approval and guarantees mortgage payments.

But there is an important distinction to make.

- Co-signers are answerable for the mortgage in the same way a borrower is. The co-signer is obligated to make monthly payments on the loan, not only the borrower’s responsibility.

- In contrast, guarantors are only responsible for the mortgage if they can’t make or have missed payments. Unlike a co-signer, the guarantor becomes liable for the loan if the primary borrower temporarily falls behind on payments.

This only happens after the lender has exhausted all other means of collecting payment from the borrower. However, a guarantor, unlike a co-signer, is not obligated in any way to make monthly payments on the loan. It is only the borrower’s responsibility.

A guarantor is less risky.

The guarantor is only there to lend their good name to help the borrower close on the mortgage. But like the co-signer, the guarantor must also have good credit. In essence, the guarantor takes less risk when helping out a borrower. The guarantor is only responsible when the borrower defaults.

guarantor must also have good credit. In essence, the guarantor takes less risk when helping out a borrower. The guarantor is only responsible when the borrower defaults.

In contrast, the co-signer takes more risk when taking on more financial responsibility. They are also in a better situation because they don’t own any part of the home. They are helping the borrower out of compassion, like a parent helping out an adult child.

Suppose guarantors want to lessen their fiscal responsibility or significantly reduce it to avoid getting involved after securing the loan with the borrower. They can get the mortgage lender on board to open an interest-bearing savings account and deposit a one-time lump sum into it.

If the mortgage value decreases—usually to around 80%–the lender will release the guarantor from the agreement and refund the money.

What are the Risks of a Co-Signer in New York?

The co-signer has to show the lender their credit history, credit score, income, debts, employment, and another financial information part of the application. The borrowers can’t secure a loan independently because lenders rely on the co-signers to increase the borrowers’ chances of qualifying for the loan. For this purpose, lenders pull hard inquiries on the co-signers’ credit as part of the loan application.

Hurts the FICO

The co-signer must proceed cautiously, as their credit score will be affected by the scoring models. So, being a co-signer for the borrower can hurt the co-signer’s credit. The mortgage will show on the co-signer’s credit report, and, as discussed, the co-signer is legally responsible for making payments on the loan if the borrower defaults.

Sometimes, the co-signer plans to apply for a home mortgage or a loan to purchase a vehicle or something else that is expensive. They may have difficulty securing such types of loans because the borrower’s loan shows on the co-signer’s credit report. Conversely, if borrowers consistently make payments on the loan on time, being co-signers can help improve their credit scores.

Can a mortgage Co-Signer Get Out of a Loan?

Yes, and it’s informally called a co-signer release. If the borrower fails to make payments on the loan or falls behind, the co-signer can request the co-signer release. It can only occur if two things happen:

- the borrower agrees to that condition and

- At the same time, he can demonstrate to the lender that he can make timely payments on the loan.

Are There Additional Risks of Being a Guarantor in New York?

Besides the financial risk, there is the relationship risk. The guarantor works with the borrower to help and may care about the borrower. For example, parents may wish to assist their adult child, and money is the ultimate gift they can give.

The risk here is that this gift or loan can ruin the relationship between the parent and the child. The parent may have second thoughts about becoming a guarantor if the adult child is not grateful. Another example is if the parent sees the child wasting money on foolish things.

The guarantor can lessen this problem by scrutinizing the borrower’s finances before assisting the borrower. The guarantor should act as a loan officer to determine if the borrower is sincere and has the ability and willingness to pay the mortgage loan each month on his or her own.

The default of the borrower

Like what may happen to a co-signer, the guarantor is also at risk because his credit score will go down if the borrower defaults. As a result, it is difficult for the guarantor to secure a loan in the future. The guarantor usually assumes that the lender will go after the borrower if that borrower fails to make payments and only after exhausting all options to reach out to the borrower.

However, lenders have the legal right to pursue the guarantor before contacting the borrower if they feel that pursuing the borrower is futile.

The guarantor will then pay for missed payments or the remaining loan amount. If the guarantor fails to pay, the latter is in default. But if the borrower is trustworthy and keeps making payments on the loan on time and in full, then the guarantor will not be affected in any way.

Then, the guarantor’s credit rating won’t take a hit. The guarantor should still be ready if the borrower defaults by having sufficient funds to cover the loan.

Can a Guarantor Get Out of a Loan?

There are reasons why a guarantor would want to relinquish his or her role if the guarantor intends to take out a loan to buy a new home.

Suppose the borrower can find another guarantor or develop additional finances (such as getting a new job that pays higher than a previous position). In that case, the lender will allow the guarantor to withdraw from the transaction. But even if there’s a new guarantor in place, it’s essential to know that the lender can disallow the switch at the lender’s discretion. The original guarantor gets stuck in the relationship with the borrower.

The guarantor can also put a safety net in place for the guarantor if the borrower defaults. The guarantor can set up an interest-bearing savings account with a lender and put a one-time lump sum into it. When the mortgage’s loan value decreases (usually to around 80%), the lender will release the loan agreement’s guarantor and refund the money.

Last Words of Wisdom

A Co-Signer or Guarantor in New York can help you qualify for a loan if you have insufficient funds or other risky financial obligations. Or, they can help you secure a larger loan or a lower interest rate. A co-signer is similar to a guarantor in that they agree to repay the loan if you can’t. Both give a lender peace of mind about extending your mortgage.

financial obligations. Or, they can help you secure a larger loan or a lower interest rate. A co-signer is similar to a guarantor in that they agree to repay the loan if you can’t. Both give a lender peace of mind about extending your mortgage.

It should be the last resort to seek help. Many risks besot the person who helps you. Why put someone in financial danger when you can wait?