What is a Bridge Loan to buy a Home in New York?

Go Back To Previous PageNew Yorkers often struggle to get the downpayment when buying a property in New York City. Getting a mortgage isn’t easy. Many options help people get to ownership of an NYC home. The two most significant concerns buyers face when getting approvals are income and the down payment. VA loans do not require a downpayment; however, civilians don’t have access to that type of loan. Saving up for a down payment isn’t easy, especially if you want to upgrade your home. Depending on the situation, buying a bridge loan to buy a house might be a good option.

How a Bridge Loan Can Help You

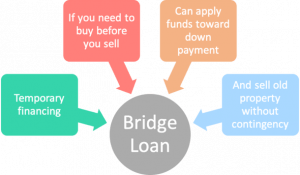

A Bridge Loan to buy a house “bridges” the gap between selling and buying. Sellers can use it to purchase a new home right away. Their funds are tied up with their home sale, which sits on the market but has not sold. This loan is short-term. Some sellers can also finance the buyer in the short term. It’s called seller’s financing.

Lenders expect to get repaid with the property sale. However, bridge loans carry high fees and interest rates. Some typical requirements to qualify are having good credit and having at least a 20% equity in your property. Most bridge loans take place in a hot real estate market.

What is a Bridge Loan to Buy a Home?

This loan provides temporary funding for a property purchase while the borrower secures longer-term financing. In the New York real estate world, buyers use bridge loans to get a downpayment ready on a new property while they wait for the sale of their own home.

buyers use bridge loans to get a downpayment ready on a new property while they wait for the sale of their own home.

Buyers use bridge loans to help get the funds necessary to buy a home, but they aren’t long-term loans. Instead, they are short-term loans that you need to pay off with the sale of your property is sold or within a year.

Why use a Bridge Loan to Buy a house?

Bridge loans can be attractive to specific buyers.

- Get a downpayment and cover closing costs.

- The approval process is quick, which makes buying a home faster.

- Some sellers will take a buyer who has a bridge loan over a buyer who doesn’t.

What is the inconvenience of having a Bridge Loan to Buy a Home?

They carry high-interest rates and high fees. The terms are short, and it’s a notoriously expensive route, but it’s a short-term solution.

When should you get a Bridge Loan to Buy a Home?

Using these loans only makes sense when looking to buy a property in a hot market. You know your home will sell and need to  move ASAP, and they are pricey and somewhat risky. However, they can make sense if you need a quick real estate closing.

move ASAP, and they are pricey and somewhat risky. However, they can make sense if you need a quick real estate closing.

How Do Bridge Loans Work?

The concept is that you will usually use your current home’s equity as leverage. There are two options:

- Pay off your original mortgage and give you extra cash for a down payment on a new home. When the house gets sold, you pay off the bridge loan.

- To create a downpayment if you have already paid off your home. You can use a bridge loan to get the downpayment, and these loans are far lower in equity.

What happens when your property is not selling?

Some lenders may extend the terms if you can’t find a buyer within a year. However, you need to pay your mortgage and the bridge loan, which can lead to a loan default. If you aren’t confident your home will sell, you shouldn’t try to get a bridge loan, which could easily backfire.

loan, which could easily backfire.

Can I Qualify For A Bridge Loan to Buy a Home?

Though all lenders will have their requirements, there are some general guidelines they follow:

- At least 20% equity in your home.

- Excellent credit. (at least 720)

- Your home must be in a hot and liquid market.

What are the Alternatives To Bridge Loans?

If a bridge loan doesn’t make sense, there are other options to meet the same goal:

- HELOC (Home Equity Lines of Credit) — is a credit line based on your home equity. HELOCs carry a better rate, lower fees, and a longer term.

A HELOC will still allow you to finance home improvements if you don’t sell your house.

A HELOC will still allow you to finance home improvements if you don’t sell your house. - 80-10-10 Loans: This involves taking out two mortgages to avoid a traditional loan’s 20 percent minimum down payment requirement. One loan is for 80 percent, the other is for 10 percent, and the rest of the down payment will only be 10 percent.

- Trying A Different Loan Type: You might not be able to get a VA loan, but you still might be able to avoid paying 20 percent down on a home through other lending methods. FHA loans, for example, only require 3.5 percent down in many cases.

- Asking For Help: Several groups help people get their home down payment despite not having the funding available. Checking the New York Housing Authority for assistance can help.