2025 Guide to NYC Buyer Agent Commission Rebates

Go Back To Previous PageWhen buying real estate in New York City, one of the first steps is to find a reliable and experienced agent who is also personable and trustworthy. However, it’s important to note that not all agents offer buyer-agent commission rebates, which can save you substantial money. Unfortunately, this is a well-kept secret in the real estate brokerage industry. But with a buyer rebate, you can use the funds to renovate or buy new furniture.

Therefore, it’s essential to ensure that you get a buyer rebate while working with your agent within the New York real estate market.

How Are Real Estate Commissions Paid in NYC?

To understand commission rebates, it’s essential to understand how commissions are paid in the real estate industry. It can be a bit complicated, so bear with us as we explain it to you. Firstly, the seller pays the listing agent a commission, usually 6% of the purchase price. The listing agent then offers to split this commission equally (50/50) with the buyer’s agent, who typically receives 3% of the purchase price.

Buyer agents often claim their services are free, which is technically accurate. This is because buyers don’t pay their agents directly. However, buyers are the only party who attend the closing table with cash, so they effectively pay for everyone’s services.

This misconception benefits real estate agents, making buyers less likely to consider the cost of using an agent. However, this is where commission rebates come in.

What Are Buyer Agent Commission Rebates in NYC?

A commission rebate for buyer agents is when a portion of their commission is given to the buyer.

This adds an extra step to the process where the agent gives back some of their commission to the buyer. The rebate amount can vary and is decided between the buyer and agent. At NestApple, buyers receive two-thirds of the total commission as a rebate.

These refunds are called “commission rebates,” “buyer rebates,” “broker rebates,” or “buyer broker rebates,” and the process is simple. The buyer can either receive a check at closing or have the rebate applied as a credit to the real estate transaction.

Are Commission Rebates Legal in NYC?

Commission rebates are legal in New York City and even encouraged by the New York Attorney General’s office to foster competition. Without commission rebates, a buyer cannot control their agent’s compensation. This means that the commission offered is the commission paid, leaving no room for negotiation.

For instance, you purchase a $1,000,000 apartment with a 3% commission. In this scenario, your agent will earn a $30,000 commission, which is a fixed amount. However, you can reduce your agent’s compensation by that same amount by receiving a rebate. If you work with NestApple, for example, you could receive a $20,000 rebate.

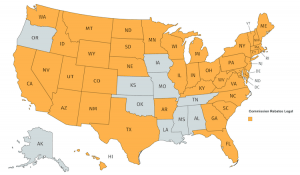

Commission rebates are legal in most parts of the United States. Although some states still do not allow them, they are becoming increasingly popular and widespread.

- In 2021, Louisiana legalized rebates.

- In 2022, Oregon clarified that rebates can be applied as transaction credits.

- Their status in Iowa isn’t straightforward, but Iowa’s Association of Realtors said in this 2021 interview that they’re generally okay as long as they’re disclosed.

Are Commission Rebates Taxable?

The answer to whether commission rebates are taxable is no. In 2007, the IRS issued a private letter ruling that considered commission rebates to be a reduction in the purchase price.

Price. If you purchased a $1,000,000 apartment with a $20,000 rebate, the IRS would consider the price paid $980,000.

Sometimes, buyers ask if they will receive a 1099 for their commission rebate. However, since the rebate is not income, they will not receive a 1099.

While the private letter ruling is not a universal rule, there have been no instances of commission rebates being taxed. Nevertheless, it is always a good idea to consult with your accountant to ensure compliance with tax regulations.

How Do Agents Feel About Buyer Rebates?

We must split the traditional broker community into two groups to answer this question.

Intelligent listing agents understand that offering a rebate to buyers is advantageous for them. The commission received by the buyer’s agent doesn’t impact the listing agent’s commission. Offering a rebate makes it easier to close deals as the buyer has to pay less.

Some traditional buyer agents may feel threatened by commission rebates because they don’t want to make less money. To justify their high commissions, they may argue that price and value are related, implying that if you pay less, you get less. However, the reality is that these agents don’t necessarily do less work when their client wants to buy a property offering a lower commission. If a property offers a 2.5% commission instead of 3%, the agent doesn’t suddenly do five-sixths of the work.

NestApple uses technology to reduce costs, increase efficiency, and give buyers savings.

How Do I Negotiate Buyer Rebates in NYC?

Any New York City real estate agent or brokerage can offer a buyer rebate. However, many agents are unwilling to reduce their commission and may even feel insulted if you suggest it. Additionally, some brokerages have minimum commission rates that prevent their agents from offering rebates.

To avoid awkward conversations or negotiations, working with a real estate brokerage that openly offers rebates is best. Nestapple’s business model is based on lower commissions, so they are happy to have you as a client and offer you a rebate.

This way, you will know exactly how much you will receive without confusion.

Regardless of who you work with, getting the rebate agreement in writing is essential to protect yourself and ensure everyone is on the same page. Note that the total commission paid to a buyer’s agent is fixed and cannot be negotiated. In New York City, all members of the Real Estate Board of New York (REBNY) and OneKey receive the same commission for a given listing.

What Are Some Possible Issues With Buyer Rebates?

When you receive a buyer rebate, you may face an issue with your loan-to-value (LTV) of the mortgage. If the rebate is not considered during underwriting, your LTV may be too high. However, it can be avoided if you inform your lender about the rebate.

For instance, when buying a home for $1,000,000 and the bank requires a 20% down payment, you would pay $200,000 and borrow $800,000. However, the rebate is typically treated as a deduction from the purchase price. If you receive a 2% rebate, the bank will consider it as if you are obtaining an $800,000 loan for a $980,000 purchase. As a result, your LTV will increase to 81.6% ($800,000 / $980,000).

Although it may not seem significant, banks are strict about these ratios, which could create problems for your transaction. The solution is simple: Inform your bank about the rebate, and they will factor it into underwriting. As long as the bank knows about it, everything should proceed quickly.

Why Aren’t Buyer Agent Commission Rebates More Common in NYC?

Commission rebates are becoming more popular, but many buyers and sellers are unaware of their existence because they lack knowledge and information.

Greed

If your boss asked you to do three times as much work for the same pay, you wouldn’t be happy, even if you had received a 50% raise over the last ten years while doing less work. This is similar to asking a “traditional” real estate agent for a commission rebate.

Although your transaction would still be profitable, they commonly become complacent and believe they deserve $700 per hour.

Transaction Size and Frequency

Traditional brokers and real estate professionals have an advantage when purchasing NYC apartments because these purchases are large and infrequent. It isn’t easy to be an expert in something you only do every 5-7 years, the average holding period for NYC real estate. First-time buyers often play it safe and assume they must pay their broker 3%.

However, when NestApple talks to repeat buyers, the conversations are much shorter because they already know what a broker does and recognize that a 3% commission is unreasonable.

Expense Structures

If a broker charged you more for doing less, they would try to keep it a secret. Most brokers spend money on flashy expenses like fancy offices and all-day car services, which are unnecessary and paid for by buyers. This has led traditional brokers to have high commissions and locked them into high-cost structures, making it impossible for them to offer rebates even if they wanted to.

However, you don’t have to use a traditional broker to navigate the housing market. You can take advantage of commission rebates instead! If you’ve made it this far, we’re sure you’d agree that everyone should get a commission rebate.